An IP centric investor focused on providing liquidity and financial solutions that are derived from the economic values of intellectual property and intellectual capital

The solutions we deliver are situational, project-based, structured and are applied across markets and technologies. ICP acquires royalties, provides IP structured financial solutions and is a financial sponsor

COMPANY OVERVIEW

- Inventive Capital is an IP centric asset management company focused on acquiring and investing in intellectual property rights and Invention Rights (“IR”) or the cash flows from patent licensing rights, patent applications, know-how and trade-marks investments in innovation intensive industries (“Industrial IP” )

- The Inventive Capital Team has successfully invested $5 billion of institutional capital in the innovations space through mediation and direct investments over 12 years producing top-quartile returns at DRI Capital ($3 billion AUM) and a Global Pension Plan's Opportunity Fund ($6 billion AUM, of which $2 billion in IP)

- The company is formed to invest its investors capital in strong technology, intellectual property technology platforms or in products manufactured by or managed by experienced management and technical teams and/or leading innovation companies who are driving broad efficiencies through:

- Transforming IP Management & Licensing practices from cost centers into profit centers

- Enhancing corporate development activities: broadening teams, divestitures, 3rd party capital sources to finance portfolio acquisitions & JVs, managing expenses and identifying off-set mechanisms

- The strategy will primarily target revenue generating Invention Rights from significantly large and diversified patent pools with favorable duration, predictability of future cash streams and meaningful option value

- The market opportunity in Industrial IP is significantly larger than the ~$35 billion invested in life sciences intellectual property over the last 12 years

- Drivers globally are corporations transitioning from closed or vertical R&D ecosystems to open or horizontal R&D ecosystem in the face of technological obsolescence and innovation; this transformed the life sciences industry more than 10 years ago

- Institutional investors who have exposure to intellectual property through life sciences IP, as well as film, music and TV have expressed an interest to expand into the Industrial IP sector

- Current annual global IP licensing and royalty revenues exceed $180 billion

- Success in this market depends on five critical factors, which are embodied in ICP practice and through its members deep experience:

- ICP team has over 60 years of collective experience (including senior advisors) in this field, covering mediation, sell-side and buy-side of the market

ICP PRINCIPALS

Gordon Winston, Founder, President & CEO

- 15 years Wall Street banking experience

- 13 years Senior Executive, IP investing and fund management experience

- Transformed public entity Drug Royalty Corporation, Inc. ((now DRI Capital (www.dricapital.com)) into a life sciences IP royalty asset management firm after $100 million going private transaction in 2002

- Raised three royalty funds and a structured finance fund, totalling over $4 billion capital commitments

- Invested $2+ billion in 40+ transactions, covering big pharma, public and private biotechnology companies, universities and institutions

Werner Frohn, Managing Director

- Diverse background of CFRO, COO and Management (fiduciary capital)

- Drove major developments for a large Global Pension Plan

- Invested $6 billion Opportunistic investments, including $2 billion in intellectual properties

- Invested in Music, Film and Pharma IP and researched the entire IP investment spectrum

- Performed due diligence on the Industrial IP sector and developed implementation strategies

ICP MARKET APPROACH

Our sourcing efforts are bifurcated along the IP Value chain, as follows:

- We have developed relationships with Inventors and Institutions

- We have initiated and are in transaction discussions with lP Executives and CFO’s of large manufacturers who are interested in monetizing parts of their current patent portfolios

Sourcing structures can include, among others:

- Primary LP interests

- Secondary LP interests

- Acquisition finance and M&A support

- Receivables contracts based on contractual payment obligations

- Collateralized loan obligations

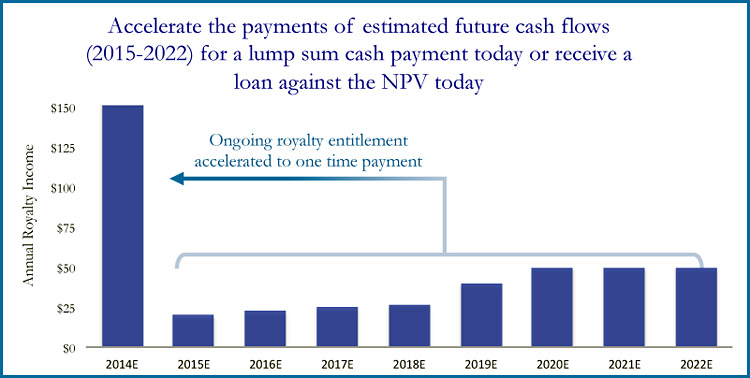

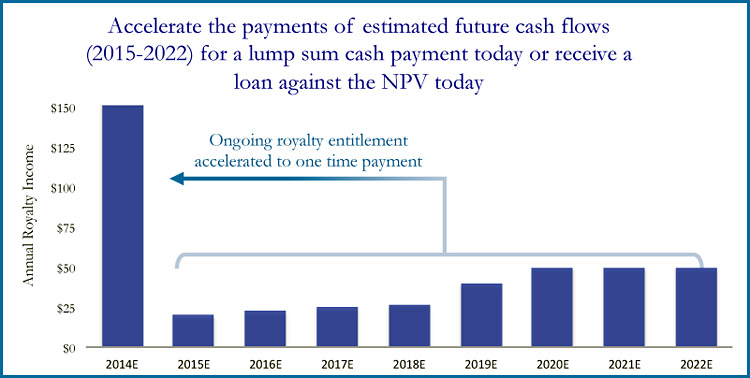

Accelerate the payments of estimated future cash flows (2015-2022) for a lump sum cash payment today or receive a loan against that value

ICP SERVICES

Win / Win for Parties Monetizing and ICP/Investors

Parties Monetizing:

- Liquidity, new financing source from a dedicated and experienced intellectual property financial investor with significant sources of institutional capital

- Financing options provided by a non-competitor, dedicated specialist and an opportunity to accelerate realizations

- Flexible transaction structures, abbreviated transaction timelines and execution certainty

- New opportunity for long term financing relationship and a JV funding source

Inventive Capital Partners:

- Diversified portfolios with substantial current cash paying components

- Long-term approach and repeatable capital deployment

- Hands-off approach from daily operations through financial/incentive alignment

- Mitigate J-curve, downside protections and flexible structures to mitigate and derive risk adjusted returns

ROLES & RESPONSIBILITIES

Inventive Capital, as the General Partner is responsible for:

- Transaction services (specific and tailor-made) focused on industry sector, counter-party status, investment structure, tax structure and portfolio construction needs. Portfolio construction needs include sector distribution, risk/return profile, exit possibilities, diversification, etc.

- Fund management services (scalable, repeatable and efficient), focused on structuring asset pools, reporting & accounting needs, risk management, performance analysis, regulatory & tax filings, compliance monitoring and client management services in the broadest sense

- Operational services through implementation and monitoring of highly aligned service agreements with licensing entities and operating companies, continuously monitor licensing activities, counter party risk and litigation procedures

- Specialty services through contracting and monitoring of highly specialized and experienced service companies in the area of patent quality assessment, valuation, patent litigation and market analysis

INVESTOR LOGIN

Login to your Inventive Capital Account: